Do We Have Any Rights as Taxpayers? (Newsletter 075)

Greetings fellow travelers.

Did you know we have a Taxpayer Bill of Rights in the United States? Or that it is listed first, as IRS Publication 1, out of several thousand official tax forms, instructions, and publications?

Today we'll discuss what it says and why it matters. Spoiler alert: Americans are pretty unhappy with how the government collects taxes.

Citizens are dissatisfied with more than the government. Turns out, we're pretty unhappy with corporations, too. You might think corporations have richly deserved their poor reputations. This week's Guest Post is from my friend Scott Owens Rohrbach. He vividly describes what happens when companies exert undue power over their employees.

I agree that corporations have terrible reputations in the public eye, even though the large majority are upstanding and law-abiding. In this week's ACC Docket article, I explore actions corporations might have to take to survive the negative press surrounding them.

Back to our main theme, taxpayer rights. For my non-American readers, IRS stands for the Internal Revenue Service. The IRS is a government agency, part of the Department of the Treasury. The IRS serves as the nation's tax collection agency and administers the Internal Revenue Code (tax code) enacted by Congress.

The IRS calls itself "one of the world's most efficient tax administrators," which surprised me. They have a poor reputation among taxpayers, with a majority rating them unfavorably. Does the IRS do a better job than tax collectors in Germany, Singapore, or Switzerland? How about compared to China or India? Read on and you can be the judge.

Bill of Rights vs. Bill of Goods

Perhaps the most famous Bill of Rights is the first ten amendments to the U.S. Constitution. I wrote about them recently in What Will You Make That Lasts? The Taxpayer Bill of Rights seems to be inspired by our Constitutional Bill of Rights, not least because it also lists ten rights.

In contrast to a bill of rights, what is a "bill of goods?" To sell someone a bill of goods means deliberately falsely presenting something. It means you're making a promise you cannot keep, despite expecting people to believe your promise.

When you claim someone is selling you a bill of goods, you're saying you've spotted their trickery and you don't like it.

Taxpayer Bill of Rights – Are They for Real?

Let's explore a couple of taxpayer rights. This will help us answer the question "Do you think Americans get the benefit of their rights?"

The Right to Be Informed

Only one in ten Americans trust themselves to file their tax return without outside help. Some 60% hire someone to do it for them, and 30% more use tax software to prepare their returns.*

* Unless otherwise noted, I took all figures from the Taxpayer Advocate Service, an independent organization within the IRS that helps taxpayers. The Taxpayer Advocate Service prepares an Annual Report to Congress that lists the "most serious problems" facing the IRS. See Reports to Congress and Research.

Here's a quote from the latest most serious problems list:

The IRS is not consistently transparent and does not provide clear and timely information about what taxpayers need to know, leaving many confused and frustrated.

Taxpayers need help because the tax code is absurdly complex. Here's how the Taxpayer Advocate describes it in the 2012 report:

The tax code has grown so long that it has become challenging even to figure out how long it is.

Estimates suggest the tax code is some four million words long, with regulations interpreting the code adding two to three times that amount.

Individuals and businesses spend more than 6 billion hours a year complying with the filing requirements of the tax code. This is the equivalent of more than three million full-time workers. Compliance costs are "a staggering 15 percent of aggregate income tax receipts."

Hmmm. If the IRS claims to be efficient, that comes at taxpayers' expense. Based on these figures, I think you'd agree that taxpayers today do not receive "clear explanations of the laws and IRS procedures."

The Right to Quality Service

Here again, the Taxpayer Advocate:

During 2021, tens of millions of taxpayers were forced to wait extraordinarily long periods of time for the IRS to process their tax returns, issue their refunds, and address their correspondence. ... At the close of the 2021 filing season, the IRS had 35.3 million returns awaiting manual processing.

And consider this: the IRS received more than 170 million phone calls in the 2021 tax season. Taxpayers connected with the IRS just nine percent of the time.

Your odds are no better by mail. The U.S. Postal Service is the IRS's primary method of corresponding with taxpayers. The IRS "has labored to timely process incoming and outgoing mail."

Taxpayer Right #2 is a clear fail.

The Right to Pay No More than the Correct Amount of Tax

The IRS audits only a fraction of tax returns, so we can't be certain individuals paid the correct tax. We can get some insight, though, from the results of the audits the IRS does perform.

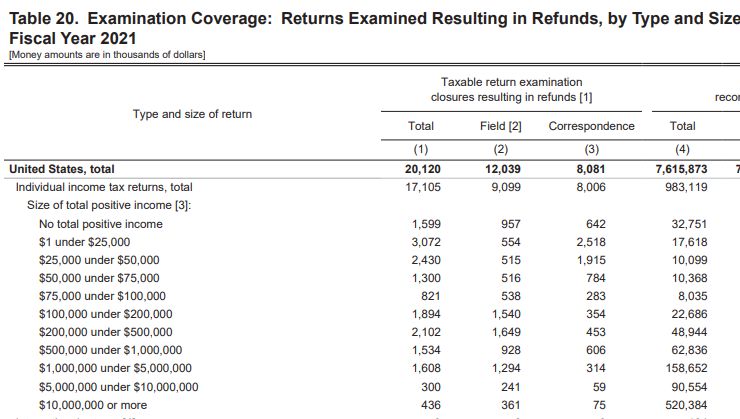

Unsurprisingly, the IRS audits people it suspects have underreported income or underpaid tax. It is alarming, therefore, that in tens of thousands of cases, the IRS finds the individual has overpaid their tax. This occurs at all income levels, with the wealthiest filers responsible for the largest refunds, more than $500 million in 2021. See IRS Databook, Table 20.

IRS audits of taxpayers at every level, including the very wealthiest, result in refunds being due, the opposite of what's expected. This hints that among the 99% unaudited returns, many more have similarly overpaid their taxes.

The Right to Privacy

In 2021, the investigative journalism organization ProPublica released confidential tax details of wealthy Americans. Their aim seems to have been to shape public policy discussions on taxes. Fair enough. But look at this statement accompanying their article:

ProPublica has obtained a vast trove of Internal Revenue Service data on the tax returns of thousands of the nation’s wealthiest people, covering more than 15 years. The data provides an unprecedented look inside the financial lives of America’s titans, including Warren Buffett, Bill Gates, Rupert Murdoch and Mark Zuckerberg. It shows not just their income and taxes, but also their investments, stock trades, gambling winnings and even the results of audits.

Then just a few months ago, the IRS reported to Congress that it had inadvertently made private information involving 120,000 taxpayers publicly visible for almost a year.

Whether through employee theft and malfeasance or bureaucratic incompetence, significant confidential taxpayer data has made its way into the public eye.

The Right to a Fair and Just Tax System

Here's how the Taxpayer Advocate described the result of a national survey of taxpayers:

Only 16 percent said they believe the tax laws are fair. Only 12 percent said they believe taxpayers pay their fair share of taxes. The National Taxpayer Advocate finds this extraordinary lack of public trust in the method by which our government is funded profoundly disturbing.

I think this one speaks for itself.

What Do You Think?

For my American readers, do you think we're getting the benefit of the Taxpayer Bill of Rights? Do we have "one of the world's most efficient tax administrators," or have we been sold a bill of goods?

For my global readers: how do you feel about your tax system and tax authorities? Are the rules clear? Do people pay their fair share?

And for anyone dissatisfied, how can we make things better?

Be well.

Thanks for reading and thanks for engaging! Leave a comment or reply to me. If you got this email from a friend and want more, subscribe to the fabulous weekly newsletter.

Member discussion