I've Got a Tip for You (Newsletter 074)

Greetings fellow travelers!

Today's post comes to you on Black Friday, appropriately enough. Our topic is something that drives me crazy about buying things in the United States: you never know how much you'll have to pay. And what you do know about the price is incomplete. "Why is that," you ask. Two reasons: sales tax and tipping.

Let me first describe the problem and then offer a simple solution. After seeing the mess we've created, I think you'll agree it's worth finding a better way.

Everything has a Price, but that's Not What You'll Pay

Here's a tip I'll give you for free: be wary of places that don't prominently display list prices, whether it's cars or clothing, hot dogs, jewelry, or anything else. There's a good chance they are trying to rip you off.

Most often, though, stores prominently display prices. This is confusing for many visitors. Particularly those that live in countries where the list price is what you in fact will pay. In America, the list price is just the starting point.

To the list price, we must start adding from among the following: state tax, local tax, municipal tax; credit card surcharges; shipping, handling, and other fees.

You won't pay all of these all the time, and that's what makes it so confusing. It depends on what you're buying, where you're buying it, sometimes what time of year you're buying it, and from whom you're buying it. The main culprit in the complexity is sales tax.

What Makes Sales Tax So Complex?

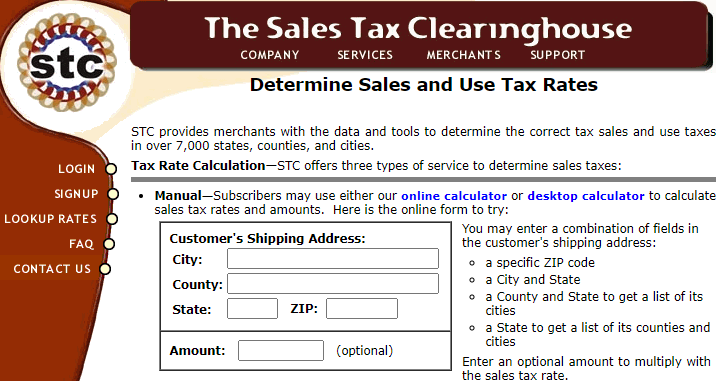

The Sales Tax Clearinghouse provides merchants with tools to determine the correct sales and use taxes in over 7,000 states, counties, and cities. Other sales tax service providers say there are more than 12,000 state and local tax jurisdictions across the United States. Authorities modify sales taxes at the rate of 5-600 per year. The combined state and local sales tax rates are generally between 5 percent and 10 percent.

Besides the crazy patchwork of sales tax rates, states vary greatly in what items they subject to the tax. According to the Tax Foundation, "most states exempt groceries from the sales tax, others tax groceries at a limited rate, and still others tax groceries at the same rate as all other products. Some states exempt clothing or tax it at a reduced rate."

Services are even more complicated. Most states tax some services, but there are many exceptions, such as services by doctors and lawyers.

States may hold temporary sales tax holidays – seventeen states will hold a sales tax holiday in 2022. The Tax Foundation says most holidays "involve politicians picking products and industries to favor with exemptions, arbitrarily discriminating among products and across time, and distorting consumer decisions."

Overall, the amount of purchases subject to sales tax ranges from 5 percent in Delaware to over 90 percent in Hawaii.

All these taxes and fees are bad enough. What's made buying things even more unpredictable is the explosion in tipping.

From the Archives

Here's a Stoic reminder why we might not want to focus primarily on money. From the idea that we might learn valuable lessons from going without, to recognizing that we are rarely satisfied no matter how much we have, this Moral Letter offers some classic perspective.

Whom Can You Tip in America?

Tipping in America requires just a few ingredients: a transaction involving at least two individuals and money changing hands, including electronically.

Even tourists are familiar with the idea of tipping in restaurants. And tipping the driver that got you there, whether by taxi or ride-sharing. (Or the valet who parks the car you drove yourself.) And it's no surprise, anyone who manages to lay a hand on your bag in a hotel, no matter how fleetingly, desires a tip.

What's less expected is being asked to tip people operating checkouts in other retail establishments. Say you order a muffin or coffee and wait to have it handed to you. The cashier will flip around the payment screen with a practiced hand for you to swipe or tap your credit card.

But before you can pay you are prompted to first select your tip: 15% to 25% seems to be the range. For what are we tipping, exactly? The 10 seconds it took someone to plunk your cookie on the counter?

You may of course select "No tip," but you do so in full view of customers behind you and under the cashier's silent disapproval when they flip back the screen. It's pure extortion, leveraging our deep human desire for social reciprocity.

The supermarket cashier probably won't seek a tip from you but may ask if you want to round up to donate to charity. Not each time, but more frequently around holidays.

You Won't Escape Buying Online Either

With the tax and tipping madness that accompanies in-person interactions, you may be tempted to retreat to buying online. If only it were so easy.

While once the internet was a tax-free oasis, vendors now must charge sales taxes based on complex rules. Where is the vendor based? Do they have a significant presence or nexus in a state? Where is the customer located? Where are the goods being shipped? Even these new rules are in flux based on court challenges and states aggressively seeking revenue.

Just like in the physical store, you will see a list price when you shop and add items to your digital cart. But you won't know what price you'll pay until you begin the checkout process. Then you'll see all the same topics rear their heads: state tax, local tax, municipal tax; credit card surcharges; shipping, handling, and other fees.

And lest you think tipping is only for in-person interactions, consider how much content we consume online. Sites increasingly allow individual creators to monetize their content by giving you the option to "Buy the author a coffee" or "Like this content? Tip the writer."

So, What's the Simple Solution?

We can choose from among several alternatives:

- Don't buy anything. Tempting but impractical, unless you can grow your food and live off the grid.

- Move to a state with no sales tax. Delaware, Montana, New Hampshire, and Oregon have neither state nor local sales taxes. Also impractical for most people.

- Mentally add a 10% sales tax to all list prices (and then a 20% tip wherever tips are common). Tell yourself it will help keep your brain sharp. Probably where most of us will end up.

- Shop in a state that has made shoplifting a misdemeanor offense (or set the felony threshold at $1,000 or more) and stop paying for your purchases altogether. More common than you might think, with 38 states fitting the bill. Shoplifting losses were estimated at over $60 billion in 2019. Although I'm not sure these were all sales tax conscientious objectors.

Or how about requiring vendors to simply post the final price for goods, including all taxes and charges? This would require some system changes, but we have all the data already. So why not?

As for tipping, I have no answer.

What do you think we should do?

Be well.

PS – We shouldn't blame companies for pricing confusion. Companies respond to incentives just like we do. As I discuss in this week's ACC Docket column, Corporations Are People Too. This has interesting implications for how we should treat them.

Like what you read today? Tip the author to support independent thinking and clear writing. (Just kidding ... unless you are feeling particularly thankful.)

Member discussion