How Valuable is Consistency? (Newsletter 068)

Greetings friends!

We are impressed by outsized results. It is not surprising that we should be fascinated by surprising events. The school dropout who starts an internet company and becomes a billionaire. The trader who comes out the winner on a gigantic bet. The video that goes viral on its way to millions of views.

Because we are so frequently confronted with such examples, we are at great risk of overestimating their likelihood. We see daily the tiniest fraction, the results of billions of experiments and attempts. From a hundred million tweets, a handful will capture the public's roving eye. Most fall quietly, unremarked. Multitudes pass by unnoticed, while the few successes grab all our rapt attention.

What does it say for a person to pursue a strategy if they have a 99% chance of failure? Now consider a person who is facing million to one odds? At what point do we look beyond the size of the potential payoff to question our investment in the project?

Experience with state lotteries is instructive. Someone wins each lottery, and because there are so many lotteries, states announce new lottery winners frequently. Never mind that in large lotteries your odds fall to a hundred million to one or worse of winning. Yes, "someone's gotta win," as the lottery marketers remind us. But for one person to win, many millions must lose.

Consider as well the other losers in the lottery of life: the school dropout who didn't become a billionaire, the video that has but 24 views, and the trader who was on the wrong side of that bet. This is not an argument against trying to do unlikely things. But it helps to understand your odds before you bet the house.

Then there are the people who take outsize risks and get away with it, for a time. Think of investment banks who earn profits for years by making large bets with borrowed money and then lose it all and more when markets move unexpectedly. Consider the base jumper or free climber. They may have successfully summited and descended a hundred times, until the one time they don't. At what point do we consider an inveterate risk-taker to be safely home with their gains intact?

You Can Achieve Large Gains Without Taking Large Risks

Today I suggest to you there is an alternative approach to achieving great things. It's not one you'll see headlining the news or discussed in online forums. But it is much more likely to put the odds in your favor. To play this alternative approach, you don't need huge luck on your side or deep pocketed investors. You need only draw upon something that you already have, which is patience. Let me explain.

Slow, steady, incremental progress is quiet and, by definition, not flashy. The magic and the power lie in consistency. Start somewhere, anywhere, and move in the direction of your choosing. A single step will suffice. Then tomorrow, do it again. And again. Whether your desire is saving money, improving your fitness, or becoming wise, you can make progress incrementally. You just need to have the patience to keep going.

Think of yourself like Kobayashi Issa's snail:

O snail

Climb Mount Fuji

But slowly, slowly!

This is such excellent advice. It applies on an individual level and on a business level. Think how many once high-flying companies had their moment and crashed back down when unrealistic expectations met harsh reality. Founders who reached for the sun, only to fall short like the great majority do.

Do not mistake me. I am not advising you to give up outrageous goals. I am urging you to use the little-traveled path up the back of the mountain to your goal. You will not reach the summit in a week, true. But you will travel farther and higher than almost everyone who makes the frontal assault.

I describe my own incremental journey in becoming a better manager In How Much Should Bosses Care About Employees? I suggest one answer there, but I acknowledge there are other approaches.

It takes discipline and conviction to stay true to a slow but steady course. Particularly when you're regularly confronted with examples of instant success. You will doubt, you will waver. If you have chosen a goal worth pursuing and are taking steps reasonably designed to get you there, then you are already successful. Stay on the path.

A Case Study: Life and Learning in the United States

I thought of this recently when I came across statistics about how the U.S. performed during the pandemic years. Apparently, the same lessons play out at the national level as well. It seems the U.S. has been taking outsized risks with children's education and citizens' health. Only now do we see the consequences of betting against the odds.

The statistics that caught my eye were these:

- Life expectancy in the U.S. dropped in 2020 and 2021 by almost three years, putting us back to where we were in the 1990s. (See CDC Life Expectancy Estimates.) 2022 does not look promising so far either. This puts the U.S. among the worst performers globally.

- Our students' reading and math scores also suffered a multi-decade hit, dropping to levels last seen in the 1990s. (See The Nation's Report Card.)

Our falling life expectancy results from a confluence of factors. Among them, three-quarters of us are overweight or obese, which is a material Covid co-morbidity. Long before Covid, though, our diets were contributing to an epidemic of metabolic syndrome and diabetes. We also need to acknowledge stubbornly persistent high death rates from cancer and heart disease, as well as deaths from overdoses.

The plummet in reading and math scores does seem to relate directly to our lengthy school closures and ineffective on-line learning substitutes. But the U.S. hardly shone in international comparisons before the pandemic. Education has become political football, and students are paying the price.

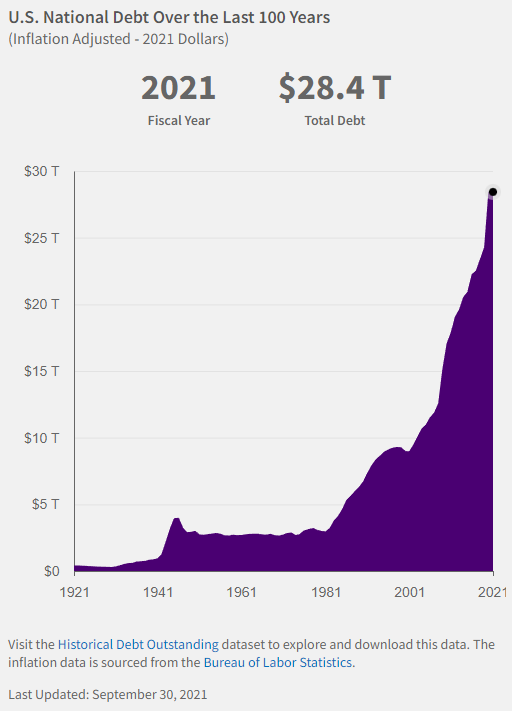

Then there's the national debt, which has ballooned to $30 trillion. In the fiscal years 2019-2021, we increased federal spending by 50%. (See Treasury.gov National Debt.) I can't help but worry we're heading towards a sudden and painful realization that this level of spending is unsustainable. Whether this is in three, five, or ten years, it is reckless to assume we will never have to pay the bill.

Everything Compounds

Today's lesson is that both good things and bad things compound over time. On a national level, we should start by acknowledging that we have been compounding bad steps for a long time. We won't fix our problems quickly. But there is a solution. It requires us to first stop adding to the problem. After that, we can start taking small steps in a positive direction.

On an individual level, we can harness the power of incremental steps to make great progress. You don't need to take outsized risk to get outsized results. I say it is better to be unassuming but unstoppable.

Be well.

PS – This week's ACC Docket article No One Cares as Much as You Do reinforces our key point: progress in any topic requires dedication and persistence, because everyone is focused on their own issues. This means that we are typically able to advance fewer issues than we would like, and making progress requires more time than we would like.

I'd love to hear from you. Just hit reply to tell me what's on your mind. If you received this mail from a friend and would like to subscribe to my free weekly newsletter, click here.

Member discussion