A Solution to the College Debt Crisis (Newsletter 052)

Greetings fellow travelers.

This week's Moral Letters set the stage well for our main topic. In Moral Letter 103 On The Greatest Threat, we explore the human tendency to worry about sensational but unlikely things. The greatest threat we face comes from our fellow humans, which provides an excellent rationale for learning how to study quietly on your own. More on this below.

Moral Letter 104 On Self Care delves into the ways that we've tried to cure our ailments over the years. Some methods work better than others, and we describe conditions that best promote our well-being. College students could certainly use this guidance to deal with the very real stress they feel from first trying to get into college, then attending, and finally paying back the crushing debt that many students incur.

We've heard a lot of noise recently about student loan forgiveness. It is just me or does this seems like a transparent bribe to buy votes? We're little better than third-world politicians handing out appliances before elections.

While emotions run high on all sides of this debate, the question whether to forgive student loans and, if so, how much to forgive ignores the elephant in the room: unless we understand how we got ourselves into this mess and address the root cause, no solution can serve as more than a temporary band aid. No matter what we do today, the problem will just recur unless we fix it.

Today I will describe how we got here. I will then explain why the proposed fix is no fix at all. And I'll end with a solution that would actually work to permanently solve the college debt crisis. Whether society is ready for this solution is another matter. I'll let you decide.

For a European visitor to the United States, nothing is more shocking than learning how America handles higher education. We tell children that a college degree is absolutely vital to their success. Then we offer them a range of choices from community college (two-year programs offering an associate's degree), to public or state schools and private universities offering four-year bachelor's degrees. To ensure that finances do not stand in the way of attending college, the Federal government (via the U.S. taxpayer) either guarantees the repayment of student loans or, since 2010, is the direct lender.

With all incentives thus aligned to encourage our youth to obtain college degrees, how are we doing? We should be basking in success, right? (The following statistics are taken from The Education Data Initiative, which itself draws upon numerous primary sources. For details, see Average Cost of College & Tuition, Education Attainment Statistics, and Student Loan Debt Statistics.)

- The percentage of young adults ages 25 to 29 who have attained at least a bachelor's degree has grown in the last 20 years from 29% to 39%.

Enjoy it, because this is possibly our last bit of good news. Why is that you ask? It's because pushing college attendance above the 30% of students who traditionally pursued a degree has cost America dearly.

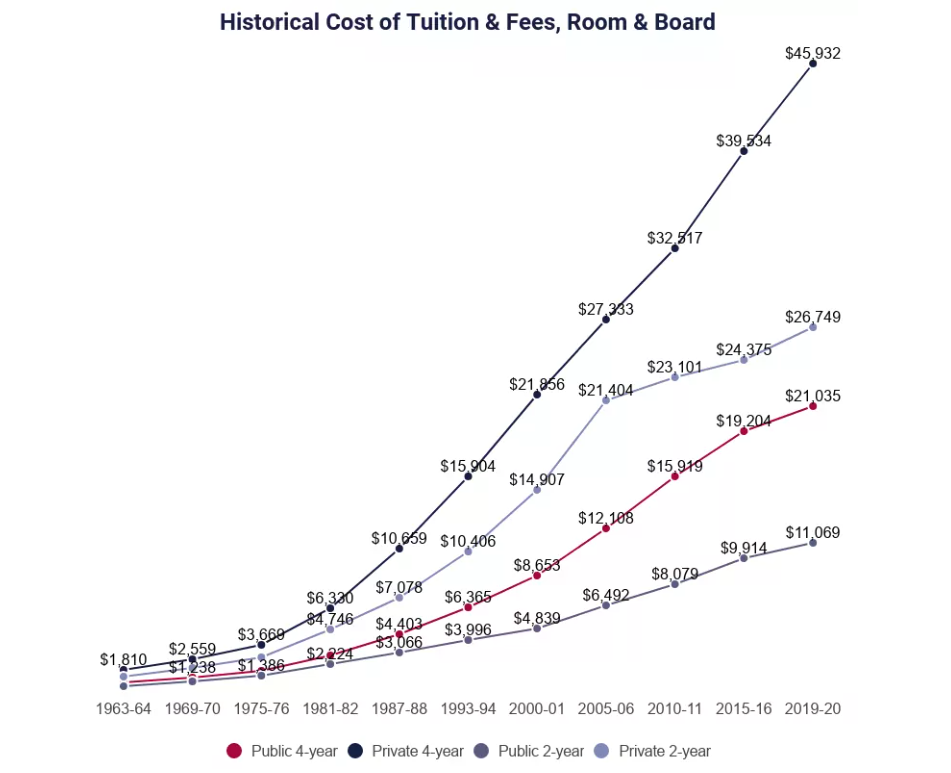

Here's one literal price we pay: the cost of college has been rising faster than almost anything else Americans consume. Steady demand combined with government-guaranteed loans meant that our colleges and universities had every incentive to raise prices. And raise prices they did.

The average four-year in-state degree now costs a bit over $100,000, while the average four-year private nonprofit degree costs well over $200,000. The fantastic rise in college costs means students must take out larger and larger loans, which leads to our first great irony: more students are dropping out of college than ever.

Because of the intense societal pressure pushing kids to go to college, among high school graduates aged 16 to 24, around 70% are enrolled in college. But did you know that fully 40% of them never complete their degree?

- Half of all college students do not complete their 4-year degrees within four years.

- Even after six years, less than 60% of students have earned their Bachelor's degree.

- The figures for community colleges are appallingly worse, with less than 20% earning their associate's degree.

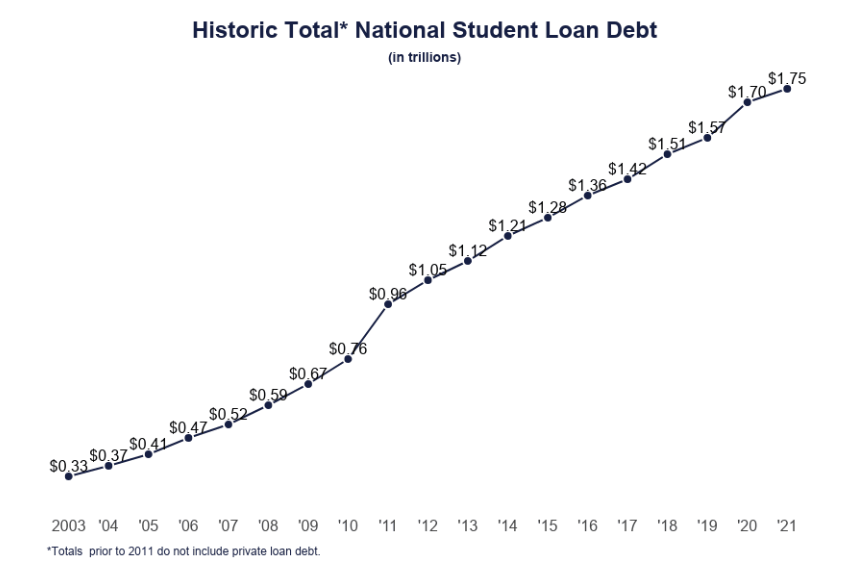

What this means is that ever more students are attending college, incurring large sums of debt, while not completing their degrees. Let's look at how the total amount of student debt has exploded:

In the last 20 years student loan debt has grown from a still large but manageable couple hundred billion dollars to $1.75 trillion. Some 43 million students owe an average of $40,000 each.

For a European, these numbers are unthinkable. Take Switzerland. Although the overall tax burden is comparable to that in the U.S., education in Switzerland is heavily subsidized by taxpayers. Swiss students have a choice of trade school or college, depending on what best suits their interests and abilities. Because both routes are entirely acceptable life paths, each with excellent earnings prospects, only about a third of students choose to go on to university. Almost no students end up taking on debt for their education costs.

Swiss universities do not have the same perverse incentives to overpay faculty, bloat their administrative staff, or recruit unsuited students. As a result, total costs of higher education remain relatively modest. But quality does not suffer. Switzerland has many fine technical schools and universities, easily ranking among the best globally.

Now let's turn to our solution. Despite its obvious success, Europe is not the U.S., and we will not fix America's college debt problems by trying to adopt European culture. We Americans are well set in our ways, and our proposed solution has to reflect reality rather than wishful thinking.

The first reality is that in America a college degree is associated with radically higher earnings. Median income more than doubles for those who have at least a bachelor's degree compared to high school graduates. Because financial success is part of the American dream, we must allow everyone equal access to college. Indeed, this is what has led to the ruinous policy of pushing all high school students on to college, whether or not they were academically suited.

The solution is so obvious I am surprised we have not yet heard it proposed by politicians: simply give each person a college degree upon their reaching the age of, say, 21. Because having a college degree results in a person earning twice as much, if we just give them a college degree, hey presto, they will earn more. For the inevitable naysayers, remember correlation and causation are just words that nerds throw around. Numbers don't lie, and these college-earning deniers need to follow the science.

Everyone can have an Ivy League degree of their choosing. No more embarrassment at Jr. having barely squeaked by at Podunk U. Now every parent's car can sport a Harvard, Stanford, or MIT bumper sticker.

Even better, this solution kills multiple birds with one stone. When we simply mail out diplomas, we have no need to send students to college. This means happy graduates incur no more student debt. What a savings to taxpayers! With one stroke, we have eliminated the student loan problem once and for all.

There's more. Because high school graduates could immediately enter the workforce, we would greatly increase the supply of entry level workers. This would solve the squeeze employers currently face with over 10 million jobs going unfilled.

For their part, colleges and their staff would be enormously relieved. No need to game admissions any more to ensure you get the exact racial mix of students currently in demand. No more whiny and entitled students looking for safe spaces. No need to build ever more lavish facilities to pamper students' every whim.

Administrative burden? Gone. Hours spent in class teaching, and then hours more grading papers? A relic of the past. With the university endowment freed of any other burden, the income stream could be repurposed to usher in that progressive dream the faculty has anyway been working towards: universal basic income. Well, at least for tenured faculty. Got to keep some standards.

How great that we could solve the homeless problem, too. No need to find space and build expensive new housing. All those dorm rooms freed of students could be easily repurposed for the drug addled, mentally ill, and dispossessed. (It's not much of a change, if you think about it.) Add the massive office space freed by tech employees working from home, and people living on the streets can soon be a thing of the past.

We should keep the college sports facilities intact, however. A lot of people are going to have much more free time on their hands. Work from home adherents, former professors on UBI, the once-homeless in their Ivy League dorms. Keeping college sports going will be a way to both generate the money we'll need to feed everyone, and to keep citizens occupied.

The benefits are staggering. I can't see any downside, can you?

Be well.

Member discussion