Financial Lessons for Us Average Folk in the Hunter Biden Indictment

Greetings friends!

I like to find the lessons in every situation, whether positive or negative. Hunter’s travails are a personal tragedy for him and his family. And we should take no pleasure in his problems.

I say if we can learn some basic financial discipline from what he got wrong, we’ll be better off for it. It is Confucius who inspires this lesson, dear readers:

If I am walking with two other men, each of them will serve as my teacher. I will pick out the good points of the one and imitate them, and the bad points of the other and correct them in myself.

You may decide which man we’re walking with when reviewing the Hunter Biden indictment for alleged willful failure to pay income tax over multiple years, among other things.

A Look at Hunter’s Spending

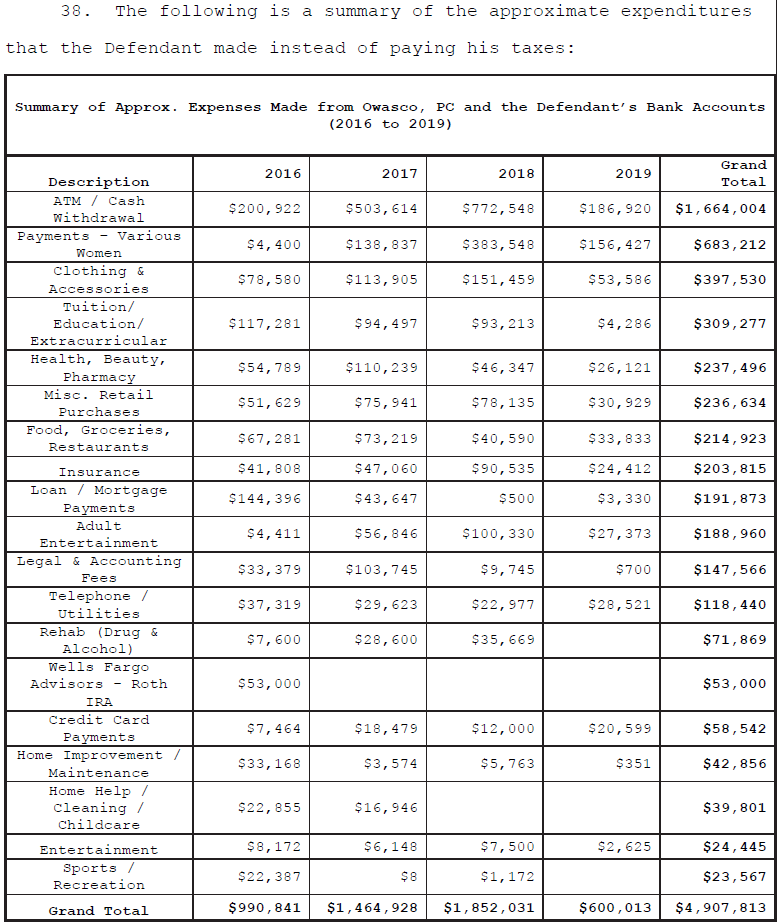

Over the four years 2016 to 2019, Hunter spent almost $5 million. How he spent it is illuminating.

Having seen the light recently itself, the U.S. government is particularly annoyed that it was not among the recipients of his largesse. That is, Hunter allegedly failed to pay income taxes and filed false returns when he did.

This is a lot of detail, so I’ve prepared a handy summary for reference:

Drugs and women ($2.6 million, 53%)

You might be reminded of WC Field’s famous quip: “I spent half my money on gambling, alcohol, and wild women. The other half I wasted.” One wonders whether Hunter similarly feels this half of his money was well spent.

Disclaimer: Given the detail with which the government breaks down Hunter’s other spending, I have included all of the “Cash Withdrawal” amounts in this category. I suppose people other than drug dealers and prostitutes deal only in cash, but probably not in such great quantities.

Clothing, health & beauty, and extracurriculars ($944K, 19%)

I can understand a person wanting to look good. Appearances are everything. And I remember how expensive a good suit can be. Did you know you can easily spend as much on a tie as your shirt?

Food, misc retail, entertainment ($500K, 10%)

A man’s got to eat. And I admit I’m impressed that Hunter had the stamina to find other avenues for spending on entertainment, sports, and recreation. It’s a testament to how much one can accomplish when they set their minds to their task.

Grownup stuff — insurance, mortgage, legal, utilities, etc. ($800K, 16%)

Let’s give him this. In a period of what appears to have been epic debauchery, he kept the mortgage paid and the lights on. This is more than many might have done.

Oh, and there’s one more category to mention: Hunter contributed $53,000 to a Roth IRA, representing 1% of his spending over the period.

Budgeting Lessons For Us All

1. Pay yourself first

When I started working at a big New York law firm, representatives from a private bank came and talked to us about financial planning. Their first tip stuck with me through today (and it’s relevant for everyone, not just well-paid lawyers): Pay yourself first.

The bankers expressed it a bit differently. They said, “Don’t count on the government being there for you when you retire.” [And doesn’t Hunter just wish that were true in his case?] We understood this to mean that if we wanted a comfortable retirement, we had to save for ourselves.

Paying yourself first does not mean living a lavish lifestyle. It means putting aside some percentage of your income for long-term savings and investment. Saving 1% of your income like Hunter did is far, far too little.

I recommend a minimum of 15% and I know many who target saving much greater amounts of their annual earnings.

2. Beware discretionary expenses that consume your budget

When your discretionary spending exceeds your fixed, “adult” spending, you are spending too much.

By adult spending, I do not mean adult entertainment, as Hunter seems to have interpreted it. I mean things like your housing, your student loans, and your insurance. Payments without which you would become homeless or bankrupt or both.

A good figure to target for everything in this category is one-third of your income. In expensive markets, housing can eat up that amount by itself. That means you must be even more careful not to let your discretionary spending grow.

Hunter’s discretionary spending seems to have been between 65% and 80% of his total income, which is far, far too high, and led to predictable disaster.

3. Don’t let small problems become big problems

This applies to both our actions and our inactions. One presumes Hunter did not start off spending millions of dollars on blow and hookers. His habits likely escalated. What started as an indulgence came to consume half of his spending.

Along the way, he engaged in another form of wishful thinking that we must studiously avoid if we wish to skirt disaster: believing that ignoring a problem means it’s gone away. It’s not true for cancer and it’s not true for tax payments. Ignoring either one will be fatal to your well-being.

We all can have lapses in judgment and go through periods of suboptimal decision-making. If we recognize it early enough, we can change our path and prevent our still little problems from becoming big problems.

When it comes to finances, I recommend periodically checking our spending and our progress. Is spending in one category getting excessive? Time to rein things back in going forward. Are our investments performing less well than hoped? Perhaps it's time to increase our savings for a while.

To Sincere Students

To a sincere student, every day is a fortunate day. For all sincere readers, my takeaways from Hunter’s mess are as follows:

- Pay yourself first, which means save for yourself before you spend on yourself.

- Beware discretionary expenses, which means making sure that the biggest portion of your spending goes to maintaining your life, not your lifestyle.

- Don’t let small problems become big problems, which means periodically checking in on your finances to correct course on areas that are becoming imbalanced.

Be well.

If you would like to (legally) receive much more in value than you spend, you’re on the right track by reading more of my work.

Member discussion